|

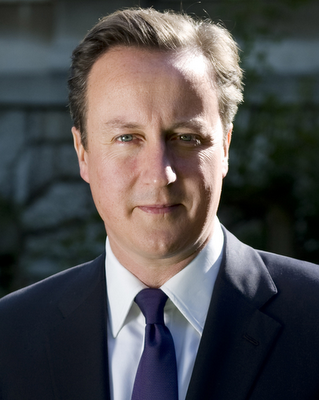

| David Cameron: economically illiterate class warrior |

"Government aide: “crap – supported by only one person in No. 10,” (Steve Hilton, allegedly)".

And Beecroft is one of the people behind the company Wonga which provides small short term 'payday' loans at 4214% and have been described by campaigners as "legal loan sharks".

The Daily Telegraph claims this is a war on red tape, but then I guess that the pundits at the Telegraph think that any legislation which makes our society fairer and gives ordinary people decent protection at the expense of their chums in business has got to be a bad thing. I have no doubt that David Cameron's, and the Telegraph's lust for worker-bashing will only be satisfied when most of us are reduced to the abject penury and wage-slavery that they and their 'free' market fundamentalist buddies appear to think ought to be the lot of all UK workers - their own children and families excepted of course.

This is pretty pernicious stuff in itself but what makes it worse is that it is economically illiterate also. These kind of so-called 'structural' changes won't make one iota of improvement to UK growth, in fact, by making people poorer they are likely to reduce it. It was James Tobin the economist who came up with the financial transaction tax known as the Robin Hood Tax who said; "structural labour market policies can make only marginal improvements".

Just as 'growth' and 'cutting red tape' are the fraudulent excuses for David Cameron waging class war on UK workers, now the government have shifted their excuses for our failing economy onto the Eurozone crisis. Before it was Labour government overspending that was the cause. So, one lie replaces another. Finally, one bit of good news today is that the Guardian now seems to have caught up with reality. Its well worth reading this editorial, and I'm quoting one of the key passages:

"At the heart of this calamitous [government] strategy is a wholesale misdiagnosis of how the market economy functions and a complete failure to understand why the financial crisis took place, the profundity of its impact and its implications for policy. For a generation, business and finance, cheered on by US neoconservatives and free market fundamentalists, have argued that the less capitalism is governed, regulated and shaped by the state, the better it works. Markets do everything best – managing business and systemic risk, innovating, investing, organising executive reward – without the intervention of the supposed dead hand of the state and without any acknowledgement of wider social obligations.

The lesson of the financial crisis is that this is complete hokum that serves the political and personal interests of the very rich."[my italics]

Really pleased to see that the Guardian has at last picked up on my "free market fundamentalist" tag. Someone must have been reading my blog :)

No comments:

Post a Comment